Interview with Simon Mellin

In 2019, Simon Mellin launched The Modern Milkman as a technology platform. In some respects it closely resembled the milk round of old, even using the same bottling machines, which have seen little to no innovation in decades. But unlike its traditional counterparts The Modern Milkman also allows customers to make and amend orders easily, and pay online without having to fish for cash, while optimising routes and small-batch logistics for its self-employed drivers and bottling partners.

Retail on the rebound

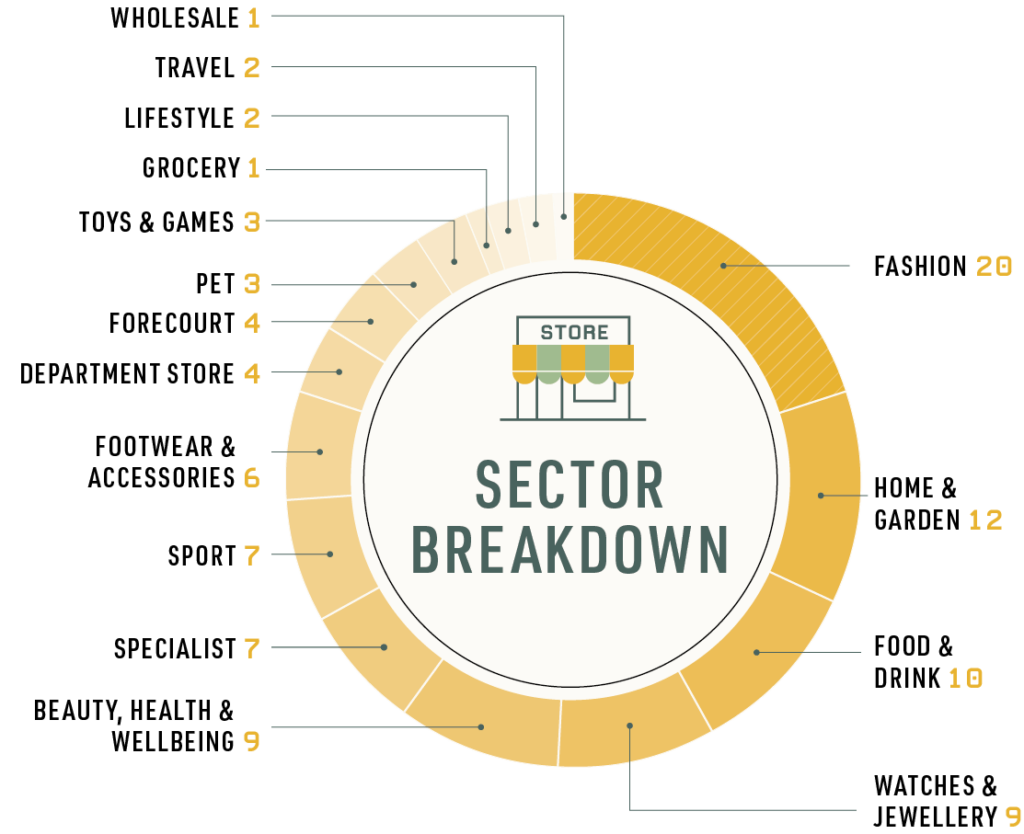

Our inaugural Retail Index tells a story of exceptional companies outperforming a sluggish market that has seen shoppers prioritise essentials like groceries during the cost-of-living crisis. Yet their impressive average 61.9% two-year CAGR indicates much more than the slow recovery of consumer confidence, following a new government, falling inflation and gradually easing interest rates. It represents the surging interest in “emotional” spending in discretionary sectors that capture the desire for relationship, hobbies, self-care and wanderlust.

Interview with Jessica Hanley

Jessica Hanley started homeware brand Piglet in Bed in her mum’s Sussex shed in 2017, selling quality, sustainable linen bedding with a scruffy chic. Instagrammers loved it, helping the business capitalise on the pandemic-era DTC boom, with sales surging sixfold between 2019 and 2021.

Interview with Freddy Ward

After a brief test period, Wild secured £500,000 in angel investor funding and launched in early 2020 with a refillable, plastic-free product. They achieved rapid growth, hitting revenues of £12.5 million the following year, and £46.9 million by the end of 2023, when it also became a certified B Corp. Total funding now stands at £7.5 million.

Winner Profile – Castore

Whatever Castore is doing, it’s doing it right. By 2021, the business was turning over £17 million. The following year, it hit £48 million. Last year, it was £115 million. Equally impressively, it has achieved this rampant growth alongside healthy margins since its early days.

Profitability is back

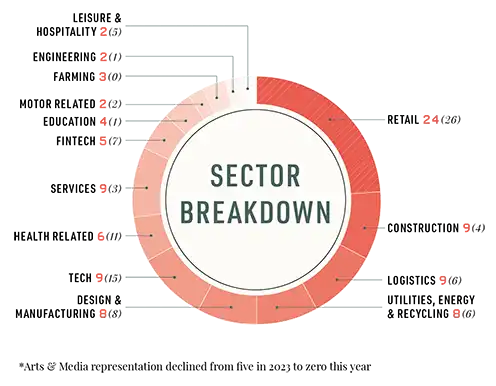

Growth Index companies can operate in any sector. They can be B2B or B2C, growing organically or via M&A. What unites them is their ability to transform their top line, putting them on a trajectory to be major players of tomorrow.

A veteran’s guide to fundraising

When growing a business, money helps. Unfortunately, there’s less of it around these days. As interest rates rose around the world, global venture capital deal-value halved between 2021 and 2023 according to Pitchbook, while exit value was the lowest since 2017.

Winner Profile – InstaVolt

In 2016, it was clear that electric vehicles (EVs) were the future of mobility. But given the rate of adoption – barely 37,000 plug-in cars were sold in the UK that year – you’d have been forgiven for thinking they weren’t the near future.

Green growth and shifting sectors

This is the year that Growth Index went green. Three of the top ten fastest-growing companies in the UK participate in the clean and renewable energy market, offering electric vehicle charging (InstaVolt)

The rise of conscious capitalism

Social and environmental impact is firmly on the corporate agenda, but the proliferation of purpose statements and ESG brochures doesn’t necessarily mean that companies are being run for the greater good