Green growth and shifting sectors

This is the year that Growth Index went green. Three of the top ten fastest-growing companies in the UK participate in the clean and renewable energy market, offering electric vehicle charging (InstaVolt), low-carbon and carbon-reducing energy services (VPI) and renewable energy equipment (CCL). Two more (cycling retailer Balfe’s Bikes and fleet management software business Ram Tracking) also contribute to reducing fossil fuel consumption.

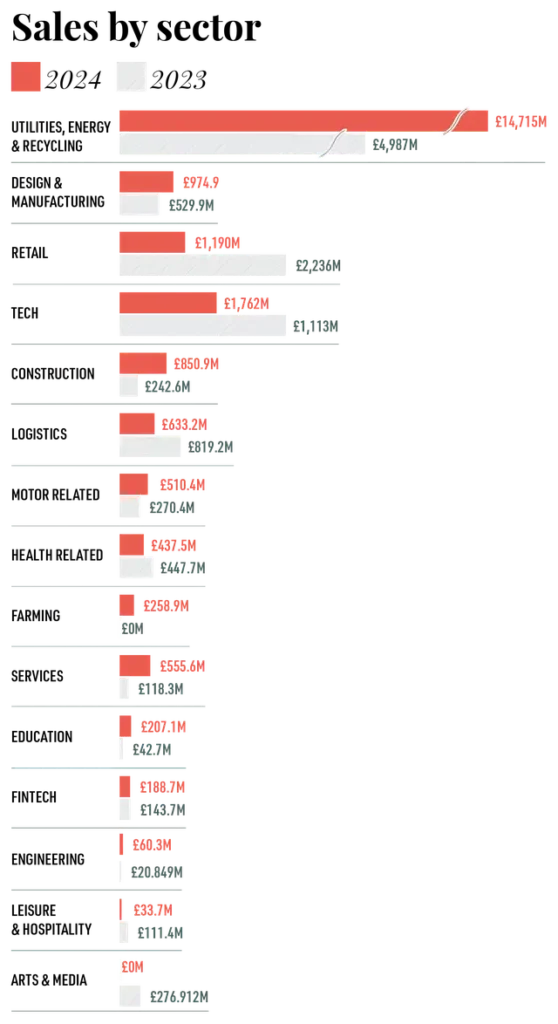

The pattern is replicated across the list, most notably in the energy, utilities and recycling sector, where seven out of our eight companies operate in some capacity across clean energy, renewables and decarbonisation.

It’s perhaps going too far to suggest that the green transition alone is what’s propelled the sector to become by far the largest by sales in Growth Index 2024, with turnover double that of all other sectors combined, and with the second-highest compound annual growth rate (CAGR) of revenues. High global energy prices clearly played their role too, as did the consolidation they prompted.

Nonetheless, the fact that the fastest-growing energy companies are disproportionately focused on green power and technology is testament to the commercial opportunities from decarbonisation. We may not expect to see this repeated on next year’s list, given the recent struggle for returns in saturated renewables and EV markets. But it’s hard to bet against clean energy as a long-term proposition, particularly as the UK government has committed to decarbonising the sector by 2035.

TECH DIPS

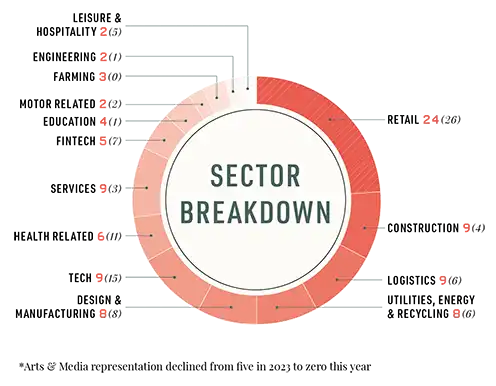

One of the more striking changes since the first Growth Index in 2022 is the retraction of tech. For many, the sector is synonymous with rapid growth, yet the number of tech firms in our top 100 has dropped two years in succession, from 22 on launch to just nine this year.

Two adjacent sectors – fintech and health – have fallen over the same period from seven to five, and 11 to six companies respectively. This is not to say these hi-tech industries haven’t produced any stars: digital healthcare provider HealthHero and fintechs Liberis and Embedded Finance all cracked the top ten. But it comes as the wider sector is facing turbulence, with over 260,000 tech workers laid off globally in 2023, a 59% increase from the previous year.

While this may reflect the new era of AI ushered in by ChatGPT in late 2022, it also corresponds to the state of equity funding, which as we showed earlier in this report, has dropped precipitously from the frenzied heights of 2021, returning to pre-pandemic levels as inflation, high interest rates and geopolitical uncertainty bit.

There is a chicken-and-egg relationship between tech growth and fundraising. When tech businesses struggle, investors prefer to keep their powder dry. But at the same time, reduced investment starves tech companies of the funds that they disproportionately use to grow.

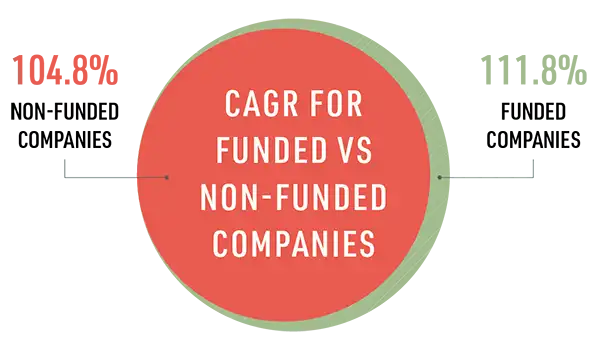

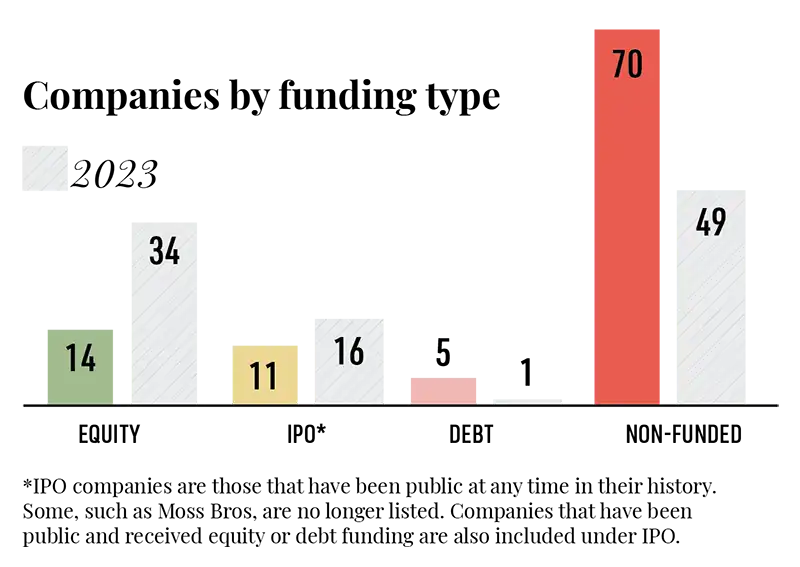

It’s hard to know which of these is the driving force in minimising tech’s place on this year’s Growth Index, but in either case it had a knock-on effect on the ownership structure of our fastest-growing companies. Only 30 of the top 100 this year have had private equity/VC backing, been crowdfunded in the past, secured large debt, or gone public, compared with 41 in 2023.

RETAIL REIGNS, INDUSTRY RETURNS

While tech retracts, retail has retained its position as Growth Index’s largest sector, with 24 businesses in our top 100, down slightly from 26 last year. This may surprise, given that consumer spending was so hard hit by the cost-of-living crisis towards the end of our reporting period.

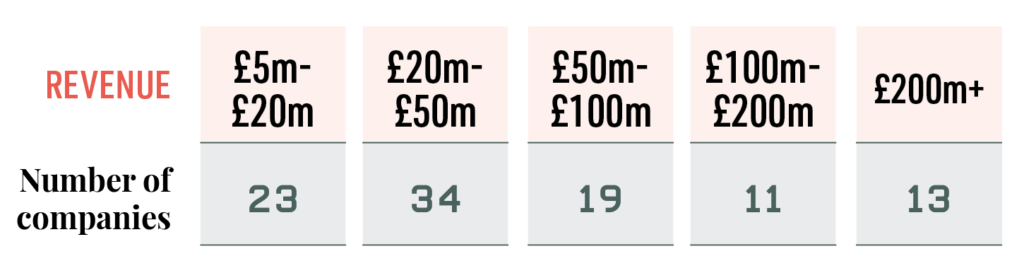

Yet the retailers on our list – ranging from police firearm importers to draft beer wholesalers – reflect the UK sector’s in-depth strength, with average CAGR significantly exceeding last year’s. This year’s fastest-growing retailers are also smaller, with average revenue dropping by nearly half, from £87m to £49.6m, though this largely reflects the relative absence of large outliers in the sector.

Leisure and hospitality only returned two businesses to the top 100, despite its profound rebound since Covid, as we decided to exclude companies where growth was largely or entirely attributable to artificially low sales in the base reporting year of 2020. Farming, meanwhile, makes its Growth Index debut in 2024, which may be in part due to post-Brexit adjustments, including a decrease in imports by 1% and an increase in exports by 2.6%, suggesting the UK may be ‘buying British’.

The biggest gainers were so-called traditional industries like manufacturing, construction and logistics. This could be a sign of a broader economic recovery from Covid lows or simply a response to the contraction in equity funding, with businesses in such sectors often more likely to stay under private ownership. It could also connect to supply chain challenges in 2021-2, benefiting those businesses nimble and effective enough to offer the most competitive products and services.

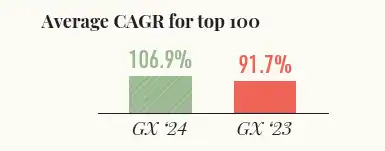

We’d like to think it represents something more: the existence of opportunity in every area of our economy. Indeed, it’s notable that the reduction in VC-funded firms hasn’t cut the average CAGR for the top 100 as a whole, as if lowering the bar for inclusion on this list. In fact, average sales growth increased this year, so we’ll watch with interest what happens to the sector breakdown in 2025.

LOCATION, LOCATION, LOCATION

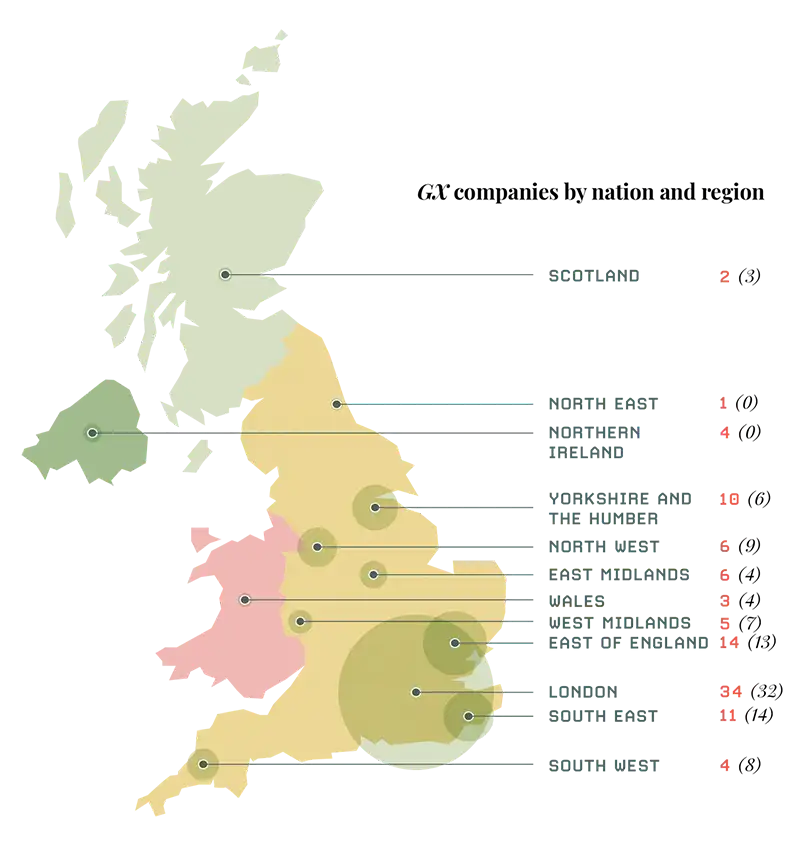

As sectors rise and fall, it would be reasonable to expect the GX 100’s geographical blend to change too. Tech, for example, is famously concentrated in the nation’s capital, while heavier industries are famously not. Yet despite only accounting for 36% of the UK population, London and its two surrounding regions (the South East and East of England) have retained their collective dominance with 59 of our top 100 companies, down by only two from 2023. They are particularly well-represented in the upper echelons, with seven of the top 10, and 68% of the top 50.

Why might this be? As Silicon Valley is to California, London is to the UK. As a world-class business ecosystem, it benefits from access to both finance

(79% of UK venture capitalists are based in London

alone, according to Beauhurst) and talent (46.7% of London’s population has a degree or equivalent according to the ONS, compared to 28.6% in the North East). Many of the world’s largest companies and top universities are also based in or around the capital.

The fact that London and the regions around it can produce high-growth champions in so many sectors year after year is testament to its strength in depth, not just in tech and fintech. Unfortunately, this seems to mean that the further you get from London, the less likely you are to see high-growth businesses. Lack of skills, insufficient infrastructure and remoteness from investors all contribute to a relative paucity of regional growth ecosystems.

Nonetheless, for the first time each of the 12 English regions and four UK nations has representation in Growth Index. Northern Ireland, which had no companies in the top 100 for the past two years, now has four. Again, it will be fascinating to see whether next year’s results will show the nations and regions rising further, and or whether the UK’s ecosystem will remain skewed to the capital.