Retail on the rebound

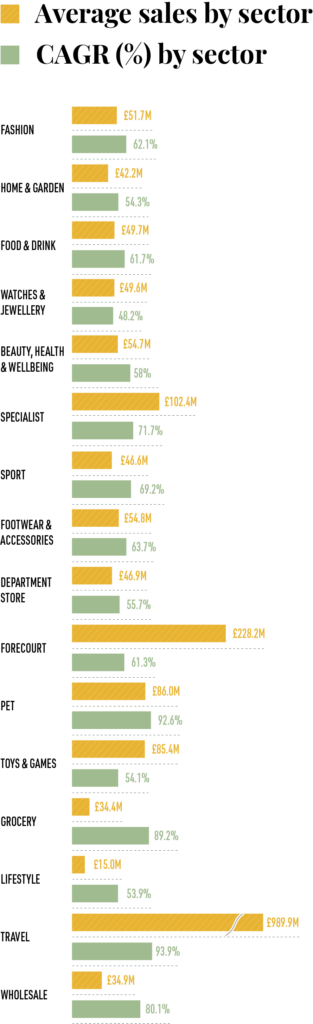

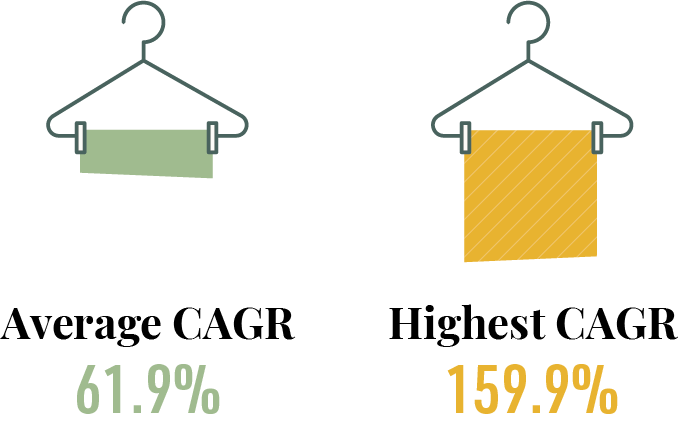

Our inaugural Retail Index tells a story of exceptional companies outperforming a sluggish market that has seen shoppers prioritise essentials like groceries during the cost-of-living crisis. Yet their impressive average 61.9% two-year CAGR indicates much more than the slow recovery of consumer confidence, following a new government, falling inflation and gradually easing interest rates. It represents the surging interest in “emotional” spending in discretionary sectors that capture the desire for relationship, hobbies, self care and wanderlust.

PURSUITS OF PLEASURE AND GOOD HEALTH

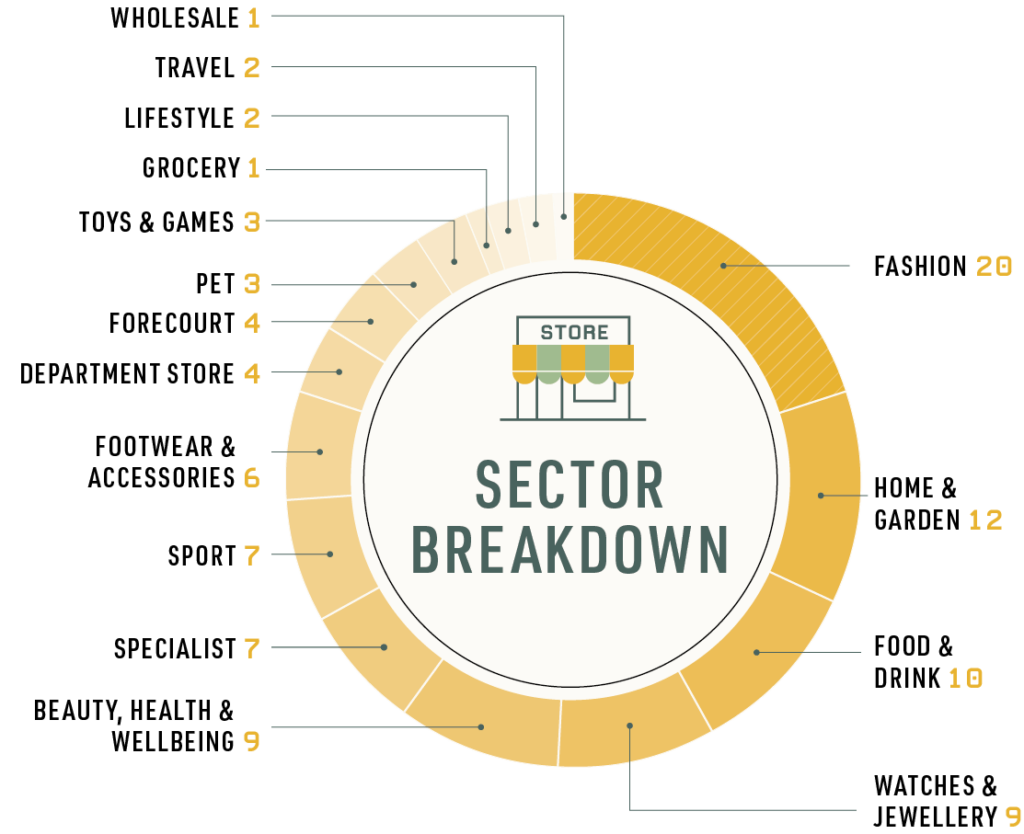

This trend is reflected in the growth trajectory of Specialists and Sports businesses. Despite representing a small share of our list overall, Specialist retailers – including those dedicated to pleasure pursuits such as books, vinyl records, comics and musical instruments – enjoyed one of the highest growth rates, with an average CAGR of 71.7% over the last two years.

Sports retailers had similar success at 69.2% – perhaps unsurprising in an Olympic year, as the category has enjoyed an upward tick here since London 2012. This is also the sector of our 2024 winner: Castore, the athletic gear favourite backed by two time gold medallist Andy Murray.

Yet our sports sector stars are not purely focused on performance wear and gym kit. We also see strong growth from retailers aligned with hobby sports such as hiking, golf and equestrian pursuits.

These businesses thrive on their deep understanding of their customers and their needs. But their success also speaks to a rekindling of Britain’s love of the great outdoors, which shows up in another standout sector, pets. The UK has welcomed over 5 million pets (mostly dogs and cats) since 2020, with well over half of households now having the companionship of a furry family member – and duly splashing out on innovative pet care products. There’s a common theme here, across pets, hobbies and sports. After the shared experience of lockdown, Britons are reconnecting with nature, and putting time and effort into looking after themselves – and smart retailers are helping them do it.

SUSTAINING GROWTH

It’s a long-term trend that’s also manifesting in the growth of another large category, Beauty, Health & Wellbeing. What’s interesting here is that relatively large, more established businesses are achieving growth rates comparable with their smaller, newer peers, despite the latter having the advantage of starting from a lower absolute base, which may largely reflect the rebound from Covid, with large companies having more ground to recover. For example, Knights Pharmacy chain, with a CAGR of over 60%, nearly matches that of Beauty Outlet, which is half the size. There were similarly impressive results from its industry peer Avicenna Pharmacy, which has 130 stores across England and Wales and a turnover of £168.2m.

The latter did suffer a steep fall in operating profit, however, announcing plans to divest non-core stores, which is a reminder for all ambitious retailers that increasing revenue is one thing; doing so profitably, year after year, is another. It’s reassuring and impressive to see larger companies expand at pace, though we note that Avicenna’s stellar revenue growth contrasts with drastic declines in operating profit, with the company having announced plans to divest non-core stores. That’s a reminder for all ambitious retailers that increasing revenue is one thing; doing so profitably, year after year, is another.

Our second-fastest-growing business, Harding+, will be all too familiar with that challenge. Focused on luxury travel retail in the cruising channel, it speaks to a revived spirit of exploration after a grim time for the industry, but also an ever-increasing consumer desire to do so responsibly.

Just three years ago, Harding+ was facing insolvency following a fallow year for international travel. Now, it is thriving, while expanding brand partnerships and modernising its sales model for a sustainable future, including leaning into pre-loved luxury accessories and adopting an ambitious zero-carbon target.

It’s possible we’re seeing customer preference for

sustainability in our Food & Drink category too: two of

our top performers there are beverage wholesaler Dayla Drinks and winery Gusbourne, which are winning over domestic customers with their home-grown produce.

DRESSING UP: FOCUS ON FASHION AND LUXURY

“When she’s sad, she goes shopping”. This memorable line describing the central character of 90s cult classic Clueless could well be applied to consumer sentiment in today’s fashion industry, which is the largest group on our list, with 20 companies. Sharp suits and short skirts abound despite recent challenges in the UK economy. Men’s formal wear, and more specifically the men’s suit market, has risen steadily since the pandemic, and is forecast to have a 4.9% global CAGR over the 9 years from 2023 to 2032. The presence of three such companies on our list – Moss Bros, Brook Taverner and Skopes – suggests cutting a dash is as important as ever, in stark contrast to the “death of the suit” narrative touted

In womenswear the standouts are Vivienne Westwood and Self-Portrait. The former had a significant rise in turnover, breaching £100m for the first time, coupled with a strong rise in operating profit over the last three years. This is pleasing to see for a legacy brand that has historically thrived on the name of its founder. Indeed, for an eponymous label to outlive its late creator is rare, especially in the context of British luxury, where even the most established brands still struggle to compete on an international stage. But the appeal of Westwood and its signature style are so strong that perhaps, like Alexander McQueen, the grande dame of British fashion’s legacy is safe.

Meanwhile, the success of younger firm Self-Portrait, which is also seeing considerable rises in both turnover and profit, reflects the desire for dressing up that the growth in men’s formal wear demonstrates – compounded by the pent-up demand for social occasions like weddings and graduations that were put on hold for Covid and are now back in full swing.

A renewed social calendar will no doubt help the Watches & Jewellery sector too. Turnover growth here has been slower than for most other sectors on our list, but it is nonetheless one of our larger categories, and profit is steadily rising. In part, this is also because of the burgeoning Gen Z and millennial market for assets that are wearable and investible in equal measure.

WHAT OUR COMPANIES HAVE IN COMMON

Emotional purchases, greater care for personal wellbeing, the revival of formalwear and the onward march of the sustainable consumer – each of these trends has created opportunities as the economy tries to leave Covid and the cost of living crisis behind it.

What unites the Retail Index companies is their skill and ability to see these trends and capitalise on them, building deep relationships with their customers. It’s why each of them can be proud to stand among the leading retailers in the country.