Methodology

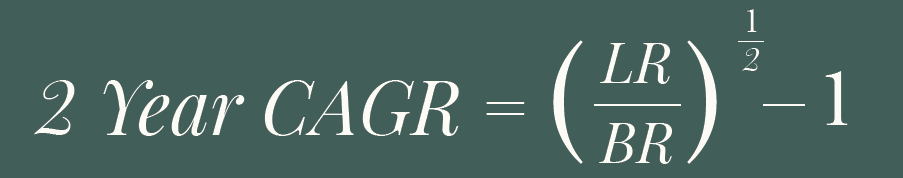

Companies are ranked by compound annual growth

of revenue over two years. To be included, companies

must be registered in the UK – however, their

ultimate holding company may be offshore. We have

no requirement on headcount, but companies must

have at least £5m in latest sales and minimum base

year sales of £100,000. We accept quoted companies

on UK and non-UK stock exchanges.

Most data was collected from Companies House

using the MarketIQ data platform in October 2024.

The exceptions are the companies that nominated

themselves by submitting their financials to us. We

did not take into account any filings that were made

to Companies House after 31 December 2024.

The majority of companies on the list have at least

three years of full accounts filed on Companies

House. The exception to this is where they have

filed two years of accounts on Companies House, in

which the sales figures for the third year are quoted,

or they file abbreviated accounts. These exceptions

came from other sources of information, such as

nominations, and were not included in the data

collected using MarketIQ. They were then analysed to

ensure they met our criteria.

Where companies’ financial periods are not equal to

52 weeks, we have made efforts to annualise these

figures when calculating their CAGR for the sake

of fairness in the rankings. Please note the figures quoted on the

table are not annualised. When companies have filed

accounts that are not in Pound Sterling, we have

converted using historic exchange rates from the end

of their specific financial period.

All data was subject to checks of the original

Companies House accounts. We then requested

that each company confirm that the figures we have

for them are correct. In the case where a company

did not respond to this request, we have made the

assumption that the Companies House data is correct

and published it as such.

The resulting list of companies was run through

additional exclusion criteria. We removed:

professional services (solicitors, underwriters,

recruiters) firms and LLPs; property developers,

motor dealerships and companies that trade in

electricity (excluding energy providers); investment

and private equity funds; joint ventures; stateowned

enterprises and nonprofit organisations;

CICs, housing associations and university-related

property companies; foreign owned businesses; and

companies that don’t file accounts on behalf of their

whole structure.

Our analysis revealed an overrepresentation of travel, hospitality, and leisure businesses within this year’s data. This trend largely reflects the disproportionate impact of the COVID-19 pandemic on these sectors. To ensure a balanced and diverse list, we prioritised companies demonstrating sustained growth trajectories. Where possible, we contextualised growth across a longer timeframe to mitigate the influence of pandemic-related surges.

Some exceptions to the criteria were made. All

the data was independently audited and passed

via panel. The compiler’s decision is final, and no

correspondence will be entered into. While all due

care was taken to check financial and other data

at Companies House and elsewhere, there may be

omissions or errors; we welcome any feedback and/

or corrections.