Retail on the rebound

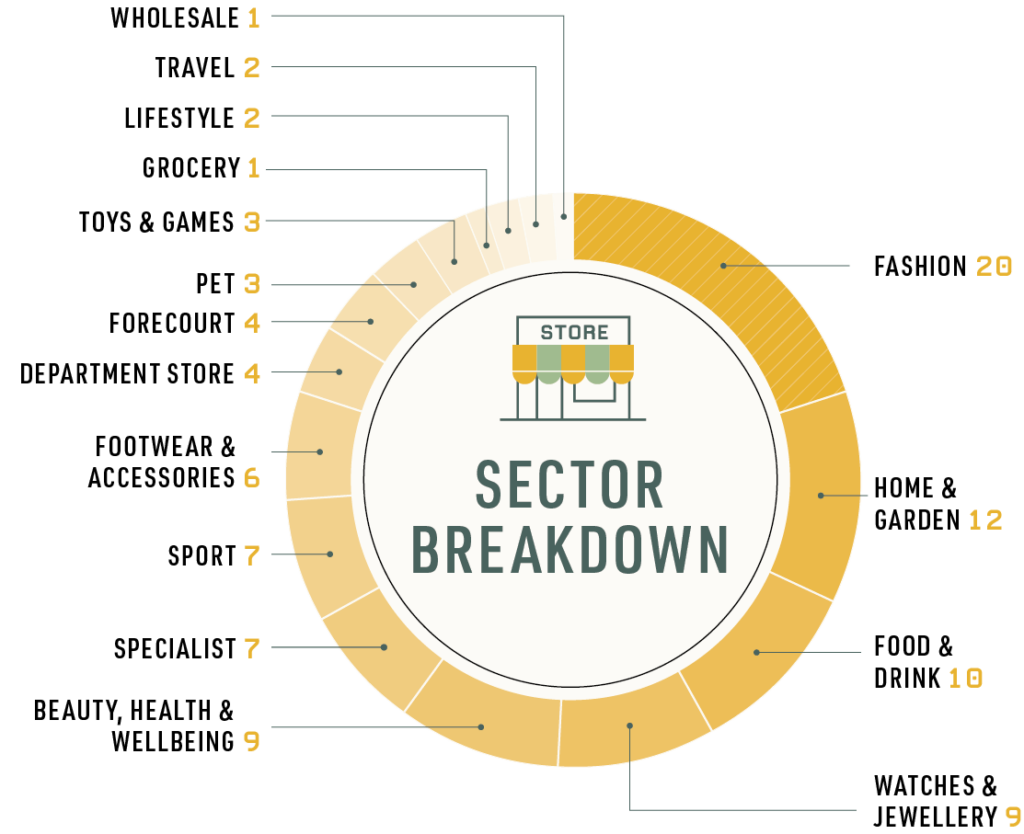

Our inaugural Retail Index tells a story of exceptional companies outperforming a sluggish market that has seen shoppers prioritise essentials like groceries during the cost-of-living crisis. Yet their impressive average 61.9% two-year CAGR indicates much more than the slow recovery of consumer confidence, following a new government, falling inflation and gradually easing interest rates. It represents the surging interest in “emotional” spending in discretionary sectors that capture the desire for relationship, hobbies, self-care and wanderlust.

Profitability is back

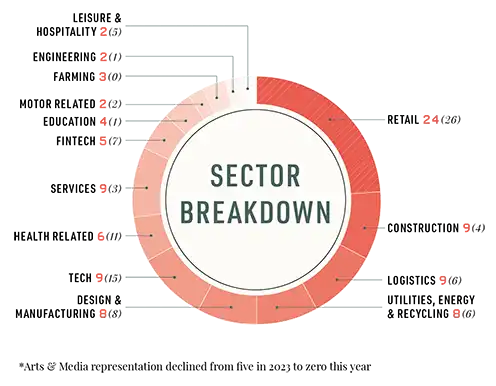

Growth Index companies can operate in any sector. They can be B2B or B2C, growing organically or via M&A. What unites them is their ability to transform their top line, putting them on a trajectory to be major players of tomorrow.

A veteran’s guide to fundraising

When growing a business, money helps. Unfortunately, there’s less of it around these days. As interest rates rose around the world, global venture capital deal-value halved between 2021 and 2023 according to Pitchbook, while exit value was the lowest since 2017.

Green growth and shifting sectors

This is the year that Growth Index went green. Three of the top ten fastest-growing companies in the UK participate in the clean and renewable energy market, offering electric vehicle charging (InstaVolt)

The rise of conscious capitalism

Social and environmental impact is firmly on the corporate agenda, but the proliferation of purpose statements and ESG brochures doesn’t necessarily mean that companies are being run for the greater good

What we can learn from the UKs top 10 retailers

In popular imagination, the fastest way to grow a business is with an app or algorithm. Yet it is retail,

not tech, that dominated this year’s Growth Index, the definitive list of the UK’s 100 fastest growing

companies.

What we can learn from the UK’s 10 fastest retailers

In popular imagination, the fastest way to grow a business is with an app or algorithm. Yet it is retail, not tech, that dominates the definitive list of the UK’s 100 fastest growing companies.

Growing pains: How to stay agile as you scale

GX leaders offer their advice for retaining entrepreneurial spirit. No company stays young forever. With success comes size, and size inevitably slows you down: eventually, today’s disruptors will themselves be disrupted.

The UK needsmore than one growth engine

The companies on this list are achieving exceptional things and deserve our warmest congratulations. Wouldn’t it be amazing if we had more of them? For too long, we’ve been like a plane running on one engine, with opportunity limited for large sections of the population. To unleash the UK’s full potential we need to get the whole country firing.

How to make purpose practical

If you ask CEOs what their company’s purpose is, very few will say to make money. Most will reel off their mission – the thing they aim for that, if satisfied, will produce a financial return.